#Tokenization Market segment

Explore tagged Tumblr posts

Text

Tokenization Market Share, Regional Scope - 2024, Business Outlook, Growth Opportunity Assessment

Global Tokenization Market was valued at USD 1.61 billion in 2021 and is expected to reach USD 5.25 billion by the year 2028, at a CAGR of 18.4%.

Tokenization is the process of transforming sensitive data into non-sensitive tokens that can be utilized in a database or internal system without being made public. Tokenization protects sensitive data by replacing it with an irrelevant value of the same length and format as the original. The tokens are subsequently delivered to an organization's internal systems to be used, while the original data is kept in a token vault. Tokenized data, unlike encrypted data, is impregnable and irrevocable. Tokens cannot be returned to their original form since the token and its original number are unrelated mathematically.

Market Dynamics and Factors:

Tokenization shields businesses from the financial ramifications of data theft. Even if there is a breach, no user personal data may be accessed. By eliminating credit card details from POS devices and internal systems, credit card tokenization helps online companies improve data security from the point of data capture to storage. Data tokenization secures credit card and bank account information in a virtual vault, allowing organizations to communicate sensitive information over wireless networks safely. Tokenization is only effective if a payment gateway is used to securely store sensitive data.

Download a Free Sample Copy of the Market Report:

https://introspectivemarketresearch.com/request/16212

Major Key Players for Tokenization Market:

American Express Company,AsiaPay Limited,Bluefin Payment Systems LLC,Card link,Fiserv Inc.,Futurex LP,HelpSystems LLC,HST Campinas SP,IntegraPay,Marqeta Inc.,Mastercard Inc.,MeaWallet AS,Micro Focus International plc,Paragon Payment Solutions,Sequent Software Inc.,Shift4 Payments LLC,Sygnum Bank AG,Thales TCT,TokenEx LLC,VeriFone Inc.,Visa Inc. and other major players.

Tokenization Market Segmentation:

By Type

Solution

Services

By Deployment

On-Premise

Cloud

By End User

Retail & E-commerce

Transportation & Logistics

BFSI

IT & Telecommunications

Others

Geographic Segment Covered in the Report

North America (U.S., Canada, Mexico)

(Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe)

(Germany, U.K., France, Netherlands, Italy, Russia, Spain, Rest of Western Europe)

(China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New Zealand, Rest of APAC)

(Turkey, Saudi Arabia, Bahrain, Kuwait, Qatar, UAE, Israel, South Africa)

(Brazil, Argentina, Rest of SA)

Inquiry Before Purchase:

https://introspectivemarketresearch.com/inquiry/16212

Scope of the Report:

The report encompasses the entire analysis of market size in previous years for major segments and countries, as well as future estimates. The Tokenization Market study looks deeply into the worldwide market's competitive landscape. The study also provides the names of key market players and the methods they used to gain a dominant position in the industry. It also includes useful market insights, dynamics and factors, and market analysis techniques such as PESTEL analysis, PORTER's Five Forces analysis, value chain analysis, SWOT analysis, BCG matrix, and Ansoff matrix.

Key Benefits for Industry Participants & Stakeholders:

Industry drivers, restraints, and opportunities covered in the study

Neutral perspective on the market performance

Recent industry trends and developments

Competitive landscape & strategies of key players

Potential & niche segments and regions exhibiting promising growth covered

Historical, current, and projected market size, in terms of value

In-depth analysis of the Tokenization Market

Purchase the Report:

https://introspectivemarketresearch.com/checkout/?user=1&_sid=16212

About us:

Introspective Market Research (introspectivemarketresearch.com) is a visionary research consulting firm dedicated to assisting our clients to grow and have a successful impact on the market. Our team at IMR is ready to assist our clients to flourish their business by offering strategies to gain success and monopoly in their respective fields. We are a global market research company, that specializes in using big data and advanced analytics to show the bigger picture of the market trends. We help our clients to think differently and build better tomorrow for all of us. We are a technology-driven research company, we analyze extremely large sets of data to discover deeper insights and provide conclusive consulting. We not only provide intelligence solutions, but we help our clients in how they can achieve their goals.

Contact us:

Introspective Market Research

3001 S King Drive,

Chicago, Illinois

60616 USA

Ph no: +1-773-382-1049

Linkedin| Twitter| Facebook

Email: [email protected]

#Tokenization Market#Tokenization Market Size#Tokenization Market Share#Tokenization Market Growth#Tokenization Market Trend#Tokenization Market segment#Tokenization Market Opportunity#US Tokenization Market#Tokenization Market Forecast#Tokenization Industry#Tokenization Industry Size

0 notes

Text

the way adrian tchaikovsky writes authoritarianism and bureaucracy and imperialism has infinitely more insight and thought than any dystopian YA novel combined. also i know this is a low bar but i really appreciate him consistently writing lgbt characters in a way that isnt performative or tokenizing or marketable. they always pleasantly surprise me. i had to stop and re-listen to a segment in which a they/them character showed up without any excess attention being drawn to the fact (though their gender is discussed thru the story in context of how it impacts their existence under a regime)

7 notes

·

View notes

Note

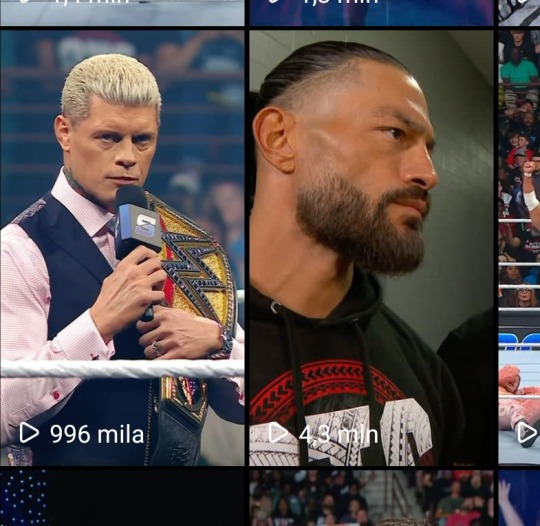

This episode of Smackdown REALLY showed Cody is not interesting at ALL. With Roman back and the bloodline in full swing, it's more clear then ever. Three people had bigger pops than the "face of the company" (even though Roman is actually advertised on everything) he's cutting promos that make him not sound so great and taking credit for things he really shouldn't be. If that man wasn't so insistent on being a babyface, I'd swear he was turning heel (he'd make a fantastic heel w his current character). I mean, he was getting bored around Roman! Plus this weekend, I don't know if you saw, Bron made a kid cry so Jey brought the kid into the ring. If that was Cody every right piece he runs to would have a story about it and would have been on the Tik token because that man doesn't have sn authentic bone in his body, but it's silent for Jey because he didn't do it for brownie points. That promo was so terrible and the difference between when we see Roman and when we see Cidy truly exposes his weaknesses

Cody is one of those people who you find in big positions but who really don't deserve to be where they are. I'm going to sound like a hater, but I don't really care... the fact is that he hasn't improved one bit from years ago: it didn't happen in NJPW, it didn't happen in AEW, it didn't happen now after his return. Cody is the same hungry boy as always, what has changed is WWE's vision of him because he negotiated his return and found himself in the right situation to fit in when everything changed in the company. New boss new top guy, simple.

The fans perception is something I consider not always reliable. Whether people like it or not, the companies have effective ways of selling products and with him they have chosen an unbeatable marketing strategy on their market (the american hero, well dressed but with principles, a dog for the kids, old values, tragic family story). But strategy alone doesn't cover everything and it's situations like this one with the Crown Jewel match that prove it.

They built nothing after his win (good matches don't make a good run in WWE, sorry) because in fact they had nothing ready for him except a match with The Rock which they are still not sure, for obvious reasons, and the feud with Randy. Unable to push the first agenda, they left him in the wake of the Bloodline as a catalyst and only now that Roman is back, they are hinting at Randy and the evolution of their feud helped by the great wrestler that KO is. And that's because they knew when Roman would be back he wouldn't take a back seat. It's what Roman does... he pushes forward. The confrontation at Summerslam and after was in fact harsh, because if they don't tell Roman to hold back like they did for WM, Cody disappears sucked into the vortex of the mainevent machine that is Roman with his storyline. The champion vs champion fight at Crown Jewel is a tragedy now... everything is wrong, the idea, the belt, the moment, the people involved because nostalgics will say it's a throwback, but neither Cody nor Gunther are attractions that sell the match when Roman is out there taking the opening, closing and backstage segments every week with a story that draws 3 million viewers on social media alone in just a few hours after SmackDown ends.

I don't like Cody, I never liked him, but I know he can be a champion now, just not THAT level of champion they're trying to sell and he think he is. He doesn't have the qualities to compare with what Roman has become and the drama is having both of them on the same show playing the same top role when they're not on the same level of aura. The confrontation is continuous and Cody has too much power for his abilities: he messes up interviews, talks about issues he shouldn't, continues to tease fans on social media, doesn't make an effort to change his approach and is lulling himself into the idea of being on top fomented by a company that is playing all possible cards to prove that they made the right choice at WM. They won't always be able to justify with the help of journalists on Twitter why after his win the views collapsed and the weekly sold out ended, why the Bloodline storyline still attract more attention and someone built organically like Jey Uso outsells the champion or have bigger reactions. But the damage is there and they can't go back because they invested and pushed too hard now. It's a problem that will only be solved when Roman retires and the company is forced to abandon its life preserver, will it work? I don't think so, because I know how it works with Cody and I don't trust him in that role, but we'll have to deal with it.

17 notes

·

View notes

Text

STON.fi: The Cornerstone of DeFi on The Open Network

Decentralized finance (DeFi) is rapidly transforming, and STON.fi is emerging as a powerhouse within The Open Network (TON). More than just a decentralized exchange (DEX), it is becoming an essential infrastructure for liquidity, trading, cross-chain integrations, and Web3 applications.

The growth of STON.fi isn’t accidental—it’s driven by continuous innovation, strong integrations, and a commitment to making DeFi more accessible. Let’s explore how STON.fi is shaping the TON ecosystem and redefining DeFi standards.

Unleashing Cross-Chain Liquidity

Liquidity is the backbone of any thriving DeFi ecosystem. STON.fi has tackled a major challenge in the industry—seamless cross-chain transfers. Through Symbiosis, STON.fi enables smooth asset movement between TON and other major blockchain networks like Ethereum and BNB Chain.

This means:

Users can swap assets across different chains without technical complexity.

More liquidity flows into the TON ecosystem, making it more attractive for traders.

DeFi adoption on TON is no longer limited by network barriers.

The integration of cross-chain swaps is a step toward positioning TON as a multi-chain DeFi hub.

The Intersection of DeFi and Web3 Gaming

Gaming is one of the fastest-growing segments in blockchain, and STON.fi is actively driving this evolution. Its partnership with Elympics allows gaming projects to connect directly with DeFi liquidity.

With this integration:

Players can convert in-game assets into tradable tokens instantly.

Developers can access STON.fi’s liquidity pools for game economies.

The gaming sector on TON gains financial utility beyond in-game rewards.

Web3 gaming is evolving, and STON.fi is at the forefront of making game assets more liquid and valuable.

Optimizing Yield with Leveraged Farming

STON.fi goes beyond simple swaps—it enhances DeFi earnings through leveraged yield farming in collaboration with Farmix.

Users can farm high-yield pools like:

STON/USDt

PX/TON

STORM/TON

By optimizing farming strategies, liquidity providers can earn higher rewards with efficient capital utilization.

AI-Driven Trading with Wisdomise

DeFi trading can be complex, but STON.fi is making it more accessible through AI-powered automation. The integration with Wisdomise introduces:

Automated limit orders for better trade execution.

Market intelligence tools that enhance decision-making.

Advanced risk management features to optimize trading.

With AI-driven automation, both beginners and experienced traders can navigate DeFi markets more efficiently.

Enhancing Payments in Web3 Gaming

TON-based gaming projects now have access to instant DeFi-powered payments through TonTickets’ integration with STON.fi.

This feature supports:

Fast conversions of gaming rewards into liquid assets.

Secure and verifiable on-chain raffles.

Integrated financial tools for Web3 game developers.

By providing seamless access to DeFi tools, STON.fi is fueling the next generation of blockchain gaming.

Bringing Institutional-Grade Security to DeFi

Adoption by financial institutions is a key milestone for DeFi. STON.fi has taken a major step forward with Zodia Custody, a regulated digital asset custodian backed by leading financial institutions.

This integration allows:

Institutional investors to securely manage TON-based assets.

STON tokens to be stored with institutional-grade security.

Increased credibility for the TON DeFi ecosystem.

With institutional backing, STON.fi is becoming a trusted entry point for large-scale capital in DeFi.

Simplifying Asset Management with Tomo Wallet

DeFi users often struggle with managing assets across multiple chains. STON.fi’s integration with Tomo Wallet solves this by offering:

Direct access to STON.fi swaps from within the wallet.

A seamless experience for managing multi-chain portfolios.

Faster liquidity access for everyday DeFi users.

This makes DeFi interactions simpler and more intuitive.

STON.fi SDK: The Backbone of Seamless Integrations

Behind all these integrations lies a powerful yet user-friendly toolset—the STON.fi SDK. It allows developers to:

Embed STON.fi’s liquidity engine with minimal effort.

Enable cross-chain transactions without complex coding.

Offer DeFi functionality to their users without reinventing the wheel.

From AI-powered trading to gaming and institutional finance, the STON.fi SDK is the silent force enabling smooth integrations across the TON ecosystem.

Final Thoughts: Why STON.fi Is Pioneering TON’s DeFi Future

STON.fi isn’t just growing—it’s reshaping the DeFi landscape on TON. With its:

Cross-chain liquidity solutions

Web3 gaming integrations

High-yield farming opportunities

AI-driven trading tools

Institutional adoption

It is proving to be an essential pillar of TON’s decentralized finance ecosystem.

For traders, developers, investors, and Web3 gamers, STON.fi offers more than just trading. It’s an evolving financial infrastructure that will define the future of DeFi on TON.

3 notes

·

View notes

Text

Boost Visibility with a Trusted Crypto PR Agency Strategy

The crypto market doesn’t wait for anyone.

It moves fast, changes quickly, and demands attention.

New tokens, tools, platforms, and communities launch every week.

Yet only a few get noticed. Only a handful attract real users, investors, and partners.

Visibility is the difference. And building that visibility isn’t about luck. It’s about having a focused and consistent communication strategy.

That’s exactly what a crypto PR agency offers.

They don’t just promote your name. They craft a strategy. One that helps your project stand out, earn credibility, and stay relevant in the long run.

Let’s explore how this strategy works—and why it’s essential today.

Visibility Isn’t Automatic

Many crypto founders think that once they build a working product, attention will follow.

But in reality, the market is too crowded.

No matter how unique or useful your project is, if people don’t see it, they won’t care.

Visibility has to be built.

A crypto PR agency builds it through a structured and practical approach. They understand the crypto audience, the right platforms, and the best timing for each piece of communication.

They don’t rely on hype. They rely on clarity and consistency.

Start with a Clear Message

Before anything else, your project needs a message.

It needs to explain what it does, why it matters, and who it’s for.

Without this, everything you communicate feels disconnected.

A crypto PR agency works with your team to shape that message.

They take your technical details and turn them into something easy to understand—without dumbing it down.

They help you express your value to both technical users and casual followers.

This message becomes the base for everything that follows—your tweets, your blog posts, your interviews, and your community engagement.

Without a clear message, no visibility strategy works.

Plan for Consistency

Crypto audiences don’t engage with random updates. They respond to rhythm.

If your communication is scattered, people lose interest. If you disappear for weeks, they forget.

A crypto PR agency helps you stay consistent.

They build a communication calendar that matches your roadmap.

They schedule posts, coordinate press releases, and guide your announcements so that you show up regularly in front of your target audience.

This ongoing visibility builds momentum. The community starts to expect updates. The media begins to watch. Influencers start to listen.

That’s how trust begins—through consistent presence.

Use the Right Channels

There are many platforms in crypto. But not all are right for your project.

Some tokens gain traction through Twitter and Telegram. Others connect better via Reddit, Medium, or podcast interviews.

Some rely on developer communities. Others lean into NFT circles.

A crypto PR agency knows where to focus.

They evaluate your project type, audience segment, and market trends.

They then choose the best mix of channels to deliver your message effectively.

Instead of being everywhere and getting lost, they help you show up where it actually matters.

Earned Media Still Matters

Getting featured in the right publication or podcast still creates impact.

It gives your project external validation. It gives users a reason to believe.

A good crypto PR agency has media contacts. They know how to pitch your story. They understand what makes it newsworthy.

They help you get listed, interviewed, and featured in places that Web3 audiences already trust.

This builds visibility that money can’t buy. It’s not an ad. It’s earned attention.

And in the eyes of your audience, that’s far more powerful.

Work with Trusted Influencers

The right influencer can bring thousands of eyes to your project. But the wrong one can hurt your reputation.

A crypto PR agency helps you avoid the wrong kind of exposure.

They identify real influencers—people with real communities, real insight, and real impact.

These voices create real discussion, not just retweets.

They also help guide the message. The best results come when influencers speak from understanding—not just reading a script.

PR teams make that happen by building real relationships between your project and their networks.

It’s not just promotion. It’s alignment.

Focus on Community Engagement

Visibility doesn’t stop at awareness. It continues with engagement.

You need to respond to comments, join conversations, and answer tough questions.

A crypto PR agency builds this into your strategy.

They help your team participate meaningfully on social media, in AMAs, and during live sessions.

They don’t just automate updates. They encourage interaction.

This builds loyalty and interest. People stick around when they feel seen and heard.

Engagement creates retention. It’s a core part of long-term visibility.

Be Ready for FUD and Pressure

Every crypto project faces criticism at some point. Whether it’s a bug, a delay, or just market speculation, someone will raise concerns.

How you handle that moment matters more than the issue itself.

A crypto PR agency helps prepare your response strategy.

They monitor community sentiment. They track discussions across platforms. When something starts to build, they alert your team early.

They then help shape a clear and calm message that addresses the concern without inflaming it.

This keeps your reputation intact—and your visibility strong.

Launches Need Coordination

Whether you’re launching a token, a new feature, or an NFT collection, timing is key.

If your launch communication is unorganized, people miss it. If your team posts too late, the moment is gone.

A crypto PR agency builds a coordinated launch strategy.

They guide your timeline, content, and media outreach.

They create a launch week campaign across social, media, and influencer channels.

They make sure everything aligns to create one clear message at the right time.

This brings the visibility boost you need right when it matters most.

Post-Launch Is Not the End

Many teams lose momentum after launch. They stop posting. They stop engaging. They assume the work is done.

But visibility doesn’t peak at launch. It continues through updates, milestones, and growth.

A crypto PR agency stays involved post-launch.

They help maintain the attention you’ve earned. They share news, roadmap progress, partnerships, and community stories.

This keeps your audience engaged and helps attract new interest over time.

Long-term visibility requires ongoing effort. PR teams provide that continuity.

Turn Visibility Into Opportunity

The ultimate goal isn’t just to be seen. It’s to grow.

Visibility brings in more than users. It brings investors, partners, builders, and collaborators.

Each piece of earned attention becomes a door to new opportunities.

But this only happens when your message is clear, your voice is consistent, and your presence is steady.

A crypto PR agency helps you align your strategy with that bigger picture.

They make sure every effort supports your mission, your roadmap, and your business goals.

Visibility isn’t a vanity metric—it’s leverage.

Final Thoughts

Crypto is fast. Projects rise and fall in weeks.

If you want to last, you need more than a smart contract. You need a smart communication strategy.

A crypto pr agency gives you that.

They help you build visibility that lasts. They help you speak with clarity. They help your project stay relevant in an ever-changing market.

They don’t promise hype. They promise structure, reach, and trust.

If your project is ready to grow, don’t leave communication to chance. Make visibility part of your roadmap.

And let a trusted crypto PR agency help lead the way.

0 notes

Text

The Hottest Memecoin News Online in June 2025

The memecoin market in June 2025 has erupted with surprising trends, political influence, and unexpected new players dominating the charts. What began as internet humour has grown into a serious—and volatile—segment of the cryptocurrency industry. If you're searching for the latest memecoin news online, this month’s developments are too big to ignore.

1. Dogecoin (DOGE): The Undisputed Meme Pioneer

Dogecoin, the original memecoin, continues to dominate discussions in the crypto world. While its price has shown some volatility this month, its legacy and massive online following keep it in the spotlight. It remains one of the most searched topics in memecoin news online, and many still see DOGE as the cultural heart of the meme coin economy.

2. Shiba Inu (SHIB) and Pepe (PEPE): Leading the Momentum

SHIB and PEPE have shown explosive growth in June 2025. Shiba Inu surged by nearly 10%, and PEPE spiked close to 20% in just a few days. Both coins have maintained massive trading volumes and a loyal online community. These gains are keeping them at the centre of memecoin news online, as investors search for the next viral winner.

3. $TRUMP Token: Where Crypto Meets Politics

One of the most talked-about launches this year is the politically driven $TRUMP token. Introduced earlier in 2025, it quickly became a controversial headline across crypto forums and major news platforms. Some hail it as a revolution in political fundraising through decentralised assets, while critics question its ethics. Either way, it’s dominating memecoin news online and sparking global attention.

4. Solana-Based Memecoins: Innovation and Hype Collide

Solana is now a hotspot for next-generation memecoins. In June 2025, Solana-based tokens have attracted immense interest:

Bonk (BONK) and Dogwifhat (WIF) continue to lead the charge with strong market caps.

AURA saw a stunning 50x overnight surge, shaking up trading communities.

Mixie (MIXIE), a gaming-inspired cat memecoin, is gaining fans for its fun utility and fast growth.

Solaxy (SOLX) is gaining traction for its blend of staking and community features.

These tokens are rapidly gaining visibility in memecoin news online, signalling that Solana may be the blockchain of choice for future meme innovations.

5. New Memecoins to Watch Right Now

Several up-and-coming tokens are making waves this month:

Arctic Pablo Coin (APC) has raised millions during its presale and is trending due to its weekly token burns.

SPX6900 and Gigachad (GIGA) are gaining traction among crypto influencers and meme investors.

Cardano Memecoins like SNEK, CHAD, and HOSKY are igniting fresh interest, showcasing that even Cardano is joining the memecoin movement.

These tokens are frequently mentioned in memecoin news online, with Telegram groups and Twitter feeds buzzing about their potential.

6. Why June 2025 Is a Pivotal Month for Memecoins

Several powerful trends are converging this month:

Cultural influence: Viral content is translating into real-world trading volume.

Political headlines: Crypto and politics are increasingly intersecting.

Tech innovation: Memecoins are evolving with better tokenomics and blockchain utility.

Retail engagement: A new generation of investors is fueling the meme economy through platforms and influencer campaigns.

With all of this happening at once, memecoin news online has become a key indicator of what’s trending in the wider crypto space.

0 notes

Text

Building a Profitable Crypto Exchange: What’s Working in 2025

As crypto exchanges continue to dominate the digital asset landscape, one central question arises for builders and entrepreneurs: how can you monetize your crypto exchange effectively in 2025? With evolving user behaviors, heightened security expectations, and a fiercely competitive market, successful monetization now goes far beyond charging trading fees. It requires a careful blend of robust features, strategic design, and a long-term business mindset. In this blog, we explore the top profit-driving features and mechanisms shaping the monetization of modern crypto exchanges in 2025.

The Evolving Crypto Exchange Landscape

The crypto exchange space has matured rapidly. No longer limited to basic trading functionality, today’s platforms are full-fledged ecosystems offering staking, lending, perpetual swaps, fiat onramps, APIs, analytics dashboards, and user education hubs. Monetization, therefore, has transformed into a multi-layered model.

Centralized exchanges (CEXs), decentralized exchanges (DEXs), hybrid models, and white-label platforms all cater to different market segments. However, regardless of the model, all exchanges must prioritize scalable revenue streams while maintaining liquidity, security, and compliance.

Trading Fees: The Foundation of Exchange Revenue

Trading fees remain the most common and reliable source of income for any exchange. Most platforms charge a percentage-based fee on each transaction, typically varying between makers and takers. In 2025, platforms are moving towards tiered fee structures based on trading volume, loyalty levels, and token holdings to incentivize higher activity and user retention.

In addition to spot trading, revenue from derivatives and margin trading has surged, driven by institutional interest and advanced retail traders. Exchanges offering perpetual contracts, futures, and leveraged positions are capitalizing on higher turnover and funding fee mechanisms. Offering dynamic spreads and real-time execution has also helped platforms capture more volume, directly contributing to profit.

Token Listings and Launchpads: A Lucrative Channel

Another prominent monetization avenue is the token listing process. New crypto projects are often willing to pay significant fees to be listed on established exchanges due to the instant access to liquidity and user visibility. While top-tier exchanges are highly selective, mid-tier and regional platforms have embraced this opportunity to generate revenue by offering customized listing packages.

In 2025, launchpad platforms integrated into exchanges have become particularly popular. These allow new projects to raise capital through token sales while the exchange benefits from both listing fees and transaction volume. For exchanges, curating high-quality projects and providing user education are key to ensuring long-term credibility and success in this monetization path.

Staking and Yield Services: Passive Income Engines

As user interest in passive income continues to grow, offering staking services has become a crucial feature for crypto exchanges. By allowing users to lock their tokens and earn rewards, platforms create an attractive utility while earning a percentage of staking rewards or management fees.

Additionally, yield farming and DeFi integration have allowed exchanges to offer flexible savings accounts, liquidity provision incentives, and vault strategies. Many centralized exchanges now mirror DeFi yield opportunities in a simplified interface, thereby monetizing through spread margins, performance fees, and token incentives.

Premium Memberships and Subscription Models

To create predictable recurring revenue, crypto exchanges are increasingly offering premium membership tiers or subscription models. These may include benefits such as reduced trading fees, early access to new listings, enhanced analytics, API limits, and priority support.

Such models cater particularly well to active traders, institutional users, and high-net-worth individuals. By segmenting users and offering added value, platforms can diversify income and foster brand loyalty. In 2025, exchanges are also experimenting with NFTs and SBTs (Soulbound Tokens) to represent membership levels and access rights, creating a new layer of engagement and monetization.

Fiat Onramps and Payment Gateways

Seamless fiat-to-crypto conversion remains one of the biggest pain points for new users. Exchanges that offer integrated onramps through bank transfers, credit cards, UPI, or local payment partners can capture a larger audience and monetize via conversion fees, spread margins, or service charges.

In many markets, especially in Asia, Africa, and South America, payment localization and regulatory clarity have become competitive differentiators. By partnering with compliant payment processors, exchanges can expand their user base while driving revenue from transactional services. In 2025, many exchanges are also earning fees from cross-border remittance services built on crypto rails, further enhancing monetization potential.

White Label Services and B2B Licensing

Some crypto exchanges are capitalizing on their infrastructure by offering white-label exchange solutions or API licensing. This model allows startups, brokers, or enterprises to launch branded exchanges using a proven backend, while the parent platform earns setup fees, hosting charges, and revenue-sharing from trade volumes.

With increasing demand for niche and localized exchanges, this B2B approach has proven to be a scalable and low-risk profit center. In 2025, top providers are also bundling compliance tools, liquidity provisioning, and custodial services into their offerings, creating complete plug-and-play exchange solutions for clients.

Advertising and Sponsored Listings

As user acquisition costs rise across Web3, crypto exchanges have started monetizing their traffic through sponsored promotions and advertising placements. This includes banner ads, featured token listings, or project promotions during launch events. Exchanges with high daily active users and global reach are well-positioned to charge premium rates for exposure.

While care must be taken to avoid spammy user experiences or reputational damage, curated advertising offers a non-intrusive monetization layer. Platforms that combine user segmentation with behavioral analytics can further refine ad targeting and optimize monetization without diluting trust.

API & Data Monetization

Exchanges generate massive volumes of trading, price, and user data daily. In 2025, data monetization has emerged as a valuable asset class. Institutions, hedge funds, market makers, and analytics firms are willing to pay for reliable, real-time or historical data feeds.

Offering paid API access with rate limits, enterprise plans, or custom feeds has become a major monetization feature. Exchanges are also licensing analytics dashboards or integrating with third-party platforms to distribute insights while earning referral revenue. Ensuring secure, well-documented, and scalable API infrastructure is key to sustaining this revenue stream.

NFT Marketplaces and Tokenized Assets

With the tokenization wave expanding, many exchanges have integrated NFT marketplaces or tokenized asset trading to diversify their product offerings. These may include real-world assets (RWAs), digital art, collectibles, or fractionalized real estate.

By earning transaction fees, listing charges, and royalties on NFT sales, exchanges tap into new user segments and increase platform stickiness. NFT staking, rentals, and financialization features like NFT lending or options trading further enhance revenue potential. In 2025, NFT trading has become an important differentiator, especially for retail-focused exchanges.

Gamification and Loyalty Rewards

Gamified user experiences have proven effective in increasing user engagement, session time, and transaction volume. Many exchanges now offer spin-the-wheel games, airdrops, trading contests, referral leagues, and mission-based rewards to incentivize activity.

While not always direct monetization tools, these features drive deeper user retention and increase average revenue per user (ARPU). Exchanges can further monetize by offering exclusive access to NFT drops, event tickets, merchandise, or token discounts through loyalty programs. These efforts contribute to long-term growth and consistent user behavior.

Security as a Service

As security threats and compliance risks increase, exchanges with robust infrastructure are offering custody, insurance, and wallet management services to enterprise clients. Cold wallet storage, multi-sig implementations, hardware integrations, and recovery mechanisms can be offered as value-added services.

By turning internal security protocols into customer-facing offerings, exchanges can unlock new revenue streams while reinforcing trust. In 2025, insured custody and SOC-2 certified wallet management are in high demand among institutional investors and high-net-worth users.

Building for Profit and Longevity

Monetization isn’t about aggressive fee extraction—it’s about building sustainable value while aligning user interests with business goals. In 2025, profitable crypto exchanges are the ones that combine seamless UX, diversified features, and adaptive revenue models. They focus not only on volume and growth but also on data insights, ecosystem partnerships, and long-term user trust.

Beyond infrastructure and liquidity, monetization success lies in choosing the right features, optimizing operations, and continuously innovating. The crypto exchange is no longer just a trading venue—it’s a multifaceted product designed for recurring revenue and enduring growth.

Conclusion

Crypto exchange monetization in 2025 is a blend of smart product design, diversified features, and a deep understanding of user needs. From trading fees and staking to launchpads and data monetization, each element contributes to a platform’s bottom line while enhancing its competitive edge. Whether you’re building a niche exchange or scaling a global platform, the path to profit lies in offering integrated, value-driven features that evolve with the market. Prioritize user trust, optimize infrastructure, and remain agile—because in the fast-moving world of Web3, sustainable monetization is a function of both innovation and reliability.

0 notes

Text

0 notes

Text

From Compliance to Protection: Drivers in the Data Centric Security Market

Data Centric Security Market Growth & Trends

The global Data Centric Security Market is projected to reach an impressive USD 24.01 billion by 2030, demonstrating a robust Compound Annual Growth Rate (CAGR) of 24.2% from 2023 to 2030, as per new reports from Grand View Research, Inc. This significant growth is primarily driven by the rapid proliferation of digital technologies and the escalating incidence of cybercrimes, which have dramatically increased the risk of cyber-attacks and data breaches for organizations worldwide. Consequently, there's a heightened demand for data-centric security solutions designed to safeguard sensitive information across various locations, both within and between organizations.

Key Drivers and Regulatory Impact

Stringent government regulations and policies across different regions are also fueling market demand. For instance, regulations like the European Union's General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA) have created a strong impetus for industries such as retail, BFSI (Banking, Financial Services, and Insurance), IT & telecom, and healthcare to implement adequate security measures.

The increasing financial and reputational repercussions of data breaches are further boosting the demand for data-centric security. A notable example is the May 2019 data breach at First American Financial Corporation, which exposed 885 million credit card applications and real estate personal and financial transaction records due to a common website design flaw. In response to such growing data breaches, organizations are making substantial investments in data-centric security solutions to mitigate risks and vulnerabilities, thereby minimizing associated costs, including remediation efforts, legal liabilities, and potential loss of user trust.

Technological Advancements and Industry-Specific Solutions

The market growth is also significantly propelled by the increasing effectiveness and efficiency of data-centric security solutions, driven by advancements in technologies such as:

Data encryption

Data masking

Tokenization

Data Loss Prevention (DLP)

These technological advancements provide organizations with more comprehensive and robust protection capabilities for sensitive information. Furthermore, the development of industry-specific data protection solutions, tailored to address the unique nature and sensitivity of data across sectors like healthcare, government, and finance, has intensified the need for advanced data-centric security solutions. This has led to increased adoption of data-centric security solutions specifically designed to tackle distinct industry challenges.

Curious about the Data Centric Security Market? Download your FREE sample copy now and get a sneak peek into the latest insights and trends.

Data Centric Security Market Report Highlights

The software segment accounts for the largest market share of over 63.3% in 2022 and is anticipated to maintain its dominance over the forecast period owing to the growing need to strengthen data privacy and regulation laws across industries such as BFSI, IT & telecom, healthcare, and retail, among others

The cloud segment is expected to observe the highest CAGR of 25.1% during the forecast period. The growing migration of data and workload to the cloud has made it essential for organizations to enhance the security and privacy of sensitive information, thereby fueling the demand for data centric security

The small & medium enterprises segment is anticipated to witness an exceptional CAGR of 24.8% during the forecast period. The growing awareness of the importance of data privacy owing to the increased media coverage of data breaches and legal requirements has enhanced the demand for data-centric security solutions in the segment

The healthcare segment is anticipated to register a considerable CAGR of 25.7% over the forecast period owing to the growing adoption of cloud platforms to store and manage sensitive information related to patient’s health, financial transaction, and other healthcare operations

North America accounted for the largest market share of over 35.2% in 2022 and is expected to retain its position over the forecast period. The growing cyber threats and crimes across industries such as retail, BFSI, and healthcare, along with the focus of government on imposing stringent data security regulations, has boosted the demand for data centric security

Data Centric Security Market Segmentation

Grand View Research has segmented the global data centric security market based on solution, deployment, enterprise size, vertical, and region:

Data Centric Security Solution Outlook (Revenue, USD Billion, 2018 - 2030)

Software

Services

Data Centric Security Deployment Outlook (Revenue, USD Billion, 2018 - 2030)

Cloud

On-premise

Data Centric Security Enterprise Size Outlook (Revenue, USD Billion, 2018 - 2030)

Small and Medium-sized Enterprises

Large enterprises

Data Centric Security Vertical Outlook (Revenue, USD Billion, 2018 - 2030)

BFSI

Government and Public Sector

Healthcare

IT and Telecom

Retail

Others

Download your FREE sample PDF copy of the Data Centric Security Market today and explore key data and trends.

0 notes

Text

Premium Credit Card Market: Key Drivers Fueling Growth, Demand, and Consumer Preference Globally

Premium Credit Card Market Drivers

The premium credit card market has witnessed significant growth in recent years, fueled by a combination of evolving consumer preferences, technological advancements, and broader economic trends. As more consumers seek enhanced financial products offering exclusive benefits and superior services, the demand for premium credit cards continues to rise. This article explores the key drivers behind the robust growth of the premium credit card market, shedding light on the factors that manufacturers, issuers, and market players should consider.

1. Rising Consumer Affluence and Spending Power

One of the primary drivers propelling the premium credit card market is the increasing affluence among consumers globally. With rising disposable incomes and greater financial literacy, more individuals are able to afford and seek out premium financial products. This growing segment of affluent consumers is inclined to invest in credit cards that offer superior rewards, privileges, and lifestyle benefits.

Premium credit cards often come with high credit limits and exclusive perks such as concierge services, luxury travel benefits, and access to airport lounges. These features appeal to high-net-worth individuals (HNWIs) and professionals who desire convenience and status in their financial dealings. The steady rise in the number of HNWIs worldwide, particularly in emerging markets, has created a substantial customer base for premium credit card issuers.

2. Increasing Demand for Exclusive Rewards and Benefits

Another significant market driver is the consumer appetite for exclusive rewards programs and benefits. Premium credit cards typically offer enhanced cashback percentages, travel miles, luxury hotel privileges, dining experiences, and personalized services that are not available with standard credit cards.

Consumers today are more value-conscious and seek to maximize returns from their spending. The appeal of earning points or miles that can be redeemed for premium experiences or products motivates cardholders to upgrade to premium cards. The introduction of tiered reward programs, partnerships with luxury brands, and co-branded credit cards further fuel demand by offering tailor-made benefits aligned with consumer lifestyles.

3. Growth of the Travel and Hospitality Sector

The premium credit card market benefits significantly from the expansion of the global travel and hospitality industry. Travel is one of the largest expense categories for premium cardholders, who often value benefits like airport lounge access, complimentary upgrades, travel insurance, and priority bookings.

As international travel resumes and consumer confidence returns post-pandemic, premium credit card issuers are capitalizing on increased travel expenditures. Collaborations with airlines, hotel chains, and travel agencies enable card issuers to offer attractive travel perks, thereby driving market growth. This synergy between the travel sector and premium credit cards acts as a powerful market growth lever.

4. Technological Advancements and Digital Innovation

Technological innovation is reshaping the premium credit card market landscape. The adoption of digital banking, mobile wallets, and contactless payments has enhanced convenience and security for premium credit card users. Card issuers are investing heavily in technology to provide seamless digital experiences, including instant issuance, real-time transaction tracking, and AI-powered fraud detection.

Moreover, advancements such as biometric authentication, tokenization, and blockchain integration increase the trust and appeal of premium credit cards. Digital platforms also enable issuers to offer personalized offers and rewards based on consumer spending patterns, further engaging premium cardholders. The intersection of technology and finance is thus a vital market growth driver.

5. Increasing Focus on Personalized Financial Services

Personalization has become a cornerstone of the premium credit card market. Issuers now emphasize understanding customer preferences and tailoring products accordingly. Premium cardholders often seek bespoke financial solutions, including customized credit limits, flexible repayment options, and exclusive financial advisory services.

This demand for personalized services drives issuers to innovate product features and improve customer engagement. Advanced data analytics and customer relationship management (CRM) tools allow card issuers to create targeted marketing campaigns and design premium cards that meet specific customer needs. This focus on personalization contributes significantly to market expansion.

6. Economic Recovery and Urbanization in Emerging Markets

Emerging economies, especially in Asia-Pacific, Latin America, and parts of Africa, are experiencing rapid urbanization, rising middle classes, and economic recovery post-pandemic. These factors collectively increase the demand for premium credit cards as consumers in urban centers adopt sophisticated financial products.

Growing awareness about credit facilities and increasing penetration of banking services in these regions present lucrative opportunities for market players. The rising youth population, more inclined toward digital banking and premium lifestyle products, further accelerates market growth. As a result, emerging markets are becoming vital growth hubs for the premium credit card industry.

7. Strategic Partnerships and Co-Branding Initiatives

Co-branding partnerships between credit card issuers and premium brands, airlines, hotels, and luxury retailers are crucial market drivers. These partnerships enhance the value proposition of premium credit cards by bundling exclusive benefits that appeal to niche customer segments.

For example, airline co-branded premium cards offer frequent flyer miles and priority boarding, while cards tied to luxury retailers provide special discounts and early access to products. Such strategic collaborations not only attract new customers but also increase customer loyalty and spending frequency, boosting the overall market size.

8. Increasing Awareness of Credit Card Benefits and Financial Inclusion

Financial education and awareness campaigns by banks, financial institutions, and governments have increased knowledge about credit card benefits. As more consumers understand the advantages of premium credit cards—such as building credit scores, managing finances efficiently, and enjoying lifestyle privileges—they are more inclined to adopt these products.

Additionally, efforts toward financial inclusion and digitization have brought previously unbanked or underbanked populations into the formal financial system, expanding the potential customer base for premium credit cards.

Conclusion

The premium credit card market is on an upward trajectory driven by multiple interrelated factors. Rising consumer affluence, demand for exclusive rewards, growth in travel and hospitality, technological innovations, and personalized services form the core drivers. The market also benefits from expanding opportunities in emerging economies, strategic partnerships, and increased financial awareness.

For market players, understanding these drivers is essential to develop competitive strategies and tailor offerings that meet evolving consumer expectations. As consumer lifestyles become increasingly premium-oriented, the demand for credit cards that offer not only financial convenience but also status, rewards, and personalized services will continue to grow, fueling the expansion of the premium credit card market worldwide.

0 notes

Text

Rising Trends and Shifting Tides in the Crypto Market

As the digital finance landscape continues to evolve, more people are seeking timely and accurate crypto news to stay ahead of market shifts. The rapid pace of development, constant innovation, and unexpected regulatory moves mean that even a few days without updates can leave investors behind. For those who want to stay informed with reliable sources, platforms like crypto news portals are becoming essential tools in this fast-paced environment.

The cryptocurrency ecosystem has transformed drastically over the past few years. What began as an experiment in decentralized finance has turned into a complex, global financial phenomenon. Bitcoin may have paved the way, but the market is now flooded with altcoins, stablecoins, and tokenized assets. This diversification has broadened the landscape, yet it has also introduced new volatility. This makes staying current with developments not just a luxury but a necessity for anyone participating in or observing the crypto market.

One major factor driving the crypto market today is institutional interest. Investment giants and financial institutions that once remained skeptical have started to embrace digital assets. They are not only investing in cryptocurrencies but are also exploring blockchain technology for efficiency gains and transparency. This growing interest often triggers rapid changes in valuation, which emphasizes the importance of real-time updates and in-depth crypto news coverage from trusted sources like Fama Crypto.

Regulation is another key topic dominating the crypto conversation. Governments around the world are no longer ignoring digital assets. Instead, they are drafting and enforcing regulatory frameworks aimed at providing clarity and protecting investors. While regulation often brings short-term uncertainty, it ultimately offers long-term stability. Market participants who understand regulatory trends are better equipped to make informed decisions. Following platforms that specialize in interpreting legal developments in the blockchain world gives readers a competitive edge.

NFTs, or non-fungible tokens, continue to be a buzzworthy element in crypto conversations. After their meteoric rise in popularity in recent years, NFTs are now evolving beyond simple digital art. They’re being integrated into gaming, music, real estate, and identity verification. The dynamic nature of this segment makes it a topic that deserves constant attention. Reliable crypto news outlets help track these evolving applications, shedding light on potential investment opportunities and risks.

Decentralized finance (DeFi) remains another focal point in the digital asset realm. DeFi platforms offer financial services like lending, borrowing, and trading without traditional intermediaries. This innovation has attracted users seeking more control and higher yields. However, the unregulated nature of many DeFi projects also introduces significant risk. Users must rely on accurate and current information to navigate this space effectively. This is where real-time insights from sources like Fama Crypto become invaluable.

0 notes

Text

Rising Trends and Shifting Tides in the Crypto Market

As the digital finance landscape continues to evolve, more people are seeking timely and accurate crypto news to stay ahead of market shifts. The rapid pace of development, constant innovation, and unexpected regulatory moves mean that even a few days without updates can leave investors behind. For those who want to stay informed with reliable sources, platforms like crypto news portals are becoming essential tools in this fast-paced environment.

The cryptocurrency ecosystem has transformed drastically over the past few years. What began as an experiment in decentralized finance has turned into a complex, global financial phenomenon. Bitcoin may have paved the way, but the market is now flooded with altcoins, stablecoins, and tokenized assets. This diversification has broadened the landscape, yet it has also introduced new volatility. This makes staying current with developments not just a luxury but a necessity for anyone participating in or observing the crypto market.

One major factor driving the crypto market today is institutional interest. Investment giants and financial institutions that once remained skeptical have started to embrace digital assets. They are not only investing in cryptocurrencies but are also exploring blockchain technology for efficiency gains and transparency. This growing interest often triggers rapid changes in valuation, which emphasizes the importance of real-time updates and in-depth crypto news coverage from trusted sources like Fama Crypto.

Regulation is another key topic dominating the crypto conversation. Governments around the world are no longer ignoring digital assets. Instead, they are drafting and enforcing regulatory frameworks aimed at providing clarity and protecting investors. While regulation often brings short-term uncertainty, it ultimately offers long-term stability. Market participants who understand regulatory trends are better equipped to make informed decisions. Following platforms that specialize in interpreting legal developments in the blockchain world gives readers a competitive edge.

NFTs, or non-fungible tokens, continue to be a buzzworthy element in crypto conversations. After their meteoric rise in popularity in recent years, NFTs are now evolving beyond simple digital art. They’re being integrated into gaming, music, real estate, and identity verification. The dynamic nature of this segment makes it a topic that deserves constant attention. Reliable crypto news outlets help track these evolving applications, shedding light on potential investment opportunities and risks.

Decentralized finance (DeFi) remains another focal point in the digital asset realm. DeFi platforms offer financial services like lending, borrowing, and trading without traditional intermediaries. This innovation has attracted users seeking more control and higher yields. However, the unregulated nature of many DeFi projects also introduces significant risk. Users must rely on accurate and current information to navigate this space effectively. This is where real-time insights from sources like Fama Crypto become invaluable.

0 notes

Text

AI Tokens Expand Market Share: From $4.5B To $20B In Two Years

In just two years, the AI crypto sector has expanded from $4.5 billion in 2023 to nearly $20 billion in 2025. This represents a fourfold increase in value, driven by technical breakthroughs, institutional attention, and early but growing use cases. Despite its fast pace, this segment still holds a small share of the crypto landscape—only 0.67% of the total market. By comparison, the

Read More: You won't believe what happens next... Click here!

1 note

·

View note

Text

Why Generative AI Platform Development is the Next Big Thing in Software Engineering and Product Innovation

In just a few years, generative AI has moved from being an experimental technology to a transformative force that’s reshaping industries. Its ability to create text, images, code, audio, and even entire virtual environments is redefining the limits of what software can do. But the real paradigm shift lies not just in using generative AI—but in building platforms powered by it.

This shift marks the dawn of a new era in software engineering and product innovation. Here's why generative AI platform development is the next big thing.

1. From Tools to Ecosystems: The Rise of Generative AI Platforms

Generative AI tools like ChatGPT, Midjourney, and GitHub Copilot have already proven their value in isolated use cases. However, the real potential emerges when these capabilities are embedded into broader ecosystems—platforms that allow developers, businesses, and users to build on top of generative models.

Much like cloud computing ushered in the era of scalable services, generative AI platforms are enabling:

Custom model training and fine-tuning

Integration with business workflows

Extensible APIs for building apps and services

Multimodal interaction (text, vision, speech, code)

These platforms don’t just offer one feature—they offer the infrastructure to reimagine entire categories of products.

2. Accelerated Product Development

Software engineers are increasingly adopting generative AI to speed up development cycles. Platforms that include AI coding assistants, auto-documentation tools, and test generation can:

Reduce boilerplate work

Identify bugs faster

Help onboard new developers

Enable rapid prototyping with AI-generated code or designs

Imagine a product team that can go from concept to MVP in days instead of months. This compression of the innovation timeline is game-changing—especially in competitive markets.

3. A New UX Paradigm: Conversational and Adaptive Interfaces

Traditional user interfaces are built around buttons, forms, and static flows. Generative AI platforms enable a new kind of UX—one that’s:

Conversational: Users interact through natural language

Context-aware: AI adapts to user behavior and preferences

Multimodal: Inputs and outputs span voice, image, text, video

This empowers entirely new product categories, from AI copilots in enterprise software to virtual AI assistants in healthcare, education, and customer service.

4. Customization at Scale

Generative AI platforms empower companies to deliver hyper-personalized experiences at scale. For example:

E-commerce platforms can generate product descriptions tailored to individual customer profiles.

Marketing tools can draft emails or campaigns in a brand’s tone of voice for specific segments.

Education platforms can create adaptive learning content for each student.

This ability to generate tailored outputs on-demand is a leap forward from static content systems.

5. Empowering Developers and Non-Technical Users Alike

Low-code and no-code platforms are being transformed by generative AI. Now, business users can describe what they want in plain language, and AI will build or configure parts of the application for them.

Meanwhile, developers get "superpowers"—they can focus on solving higher-order problems while AI handles routine or repetitive coding tasks. This dual benefit is making product development more democratic and efficient.

6. New Business Models and Monetization Opportunities

Generative AI platforms open doors to new business models:

AI-as-a-Service: Charge for API access or custom model hosting

Marketplace ecosystems: Sell AI-generated templates, prompts, or plug-ins

Usage-based pricing: Monetize based on token or image generation volume

Vertical-specific solutions: Offer industry-tailored generative platforms (e.g., legal, finance, design)

This flexibility allows companies to innovate not only on the tech front but also on how they deliver and capture value.

Conclusion

Generative AI platform development isn’t just another tech trend. It’s a foundational shift—comparable to the rise of the internet or cloud computing. By building platforms, not just applications, forward-looking companies are positioning themselves to lead the next wave of product innovation.

For software engineers, product managers, and entrepreneurs, this is the moment to explore, experiment, and build. The tools are here. The models are mature. And the possibilities are nearly limitless.

0 notes

Text

Optimizing Data Workflows with Automation, Deduplication, and RESTful APIs

In the fast-paced world of data management, businesses are constantly looking for ways to streamline workflows, reduce redundancy, and gain real-time insights. Whether you're handling customer information, sales transactions, or backend system logs, managing your data efficiently is key to staying competitive.

For organizations like Match Data Pro LLC, the combination of data deduplication API, automated data scheduling, and REST API data automation is revolutionizing how businesses handle data at scale. These technologies are not just about convenience—they offer the speed, accuracy, and scalability required for data-driven success.

Understanding Data Deduplication and Its Role in Clean Data

One of the biggest hurdles in data management is duplication. Redundant data entries can inflate storage costs, slow down analytics, and lead to inconsistent reporting. Data deduplication solves this problem by identifying and eliminating duplicate records in datasets.

A data deduplication API allows developers and systems to automatically scan and clean data repositories in real-time or at scheduled intervals. These APIs are essential for maintaining clean databases without the need for constant manual review.

For example, e-commerce companies can use deduplication APIs to ensure that customer profiles are unified, preventing issues like multiple accounts under slightly different names or emails. This ensures more accurate customer insights, better marketing segmentation, and fewer logistical errors.

Automated Data Scheduling: Set It and Forget It

Modern businesses process massive volumes of data every day. Manually triggering data tasks—whether it's syncing databases, updating dashboards, or initiating backups—is inefficient and error-prone.

That’s where automated data scheduling comes in. This technology allows companies to define a set schedule for repetitive data processes. Whether it’s hourly data syncs, nightly reports, or weekly deduplication, these schedules ensure that critical data workflows happen like clockwork.

When implemented with the right API infrastructure, automated scheduling offers a “set-it-and-forget-it” approach. Once the rules are defined, the system takes over. No more late-night SQL queries or missed report deadlines.

With Match Data Pro LLC’s automation tools, businesses can build sophisticated schedules that account for dependencies, monitor task health, and send real-time alerts when issues arise.

REST API Data Automation: The Backbone of Connected Workflows

The rise of APIs has transformed how modern apps and platforms communicate. REST APIs in particular have become the standard for enabling flexible, scalable integrations across web services.

REST API data automation enables systems to initiate or respond to data events across multiple platforms without manual intervention. With this setup, data can flow from one tool to another automatically. For instance, when a user signs up on a website, their information can be pushed to a CRM, a marketing automation platform, and an analytics dashboard—all in seconds.

Match Data Pro LLC helps organizations build and deploy REST API automation solutions that are:

Reliable: With error handling and retry logic.

Scalable: Capable of handling growing data volumes.

Secure: With encrypted connections and token-based authentication.

Whether you're looking to automate customer onboarding, financial reporting, or IoT data collection, REST APIs allow for high-performance, low-latency workflows.

Key Benefits of Combining These Technologies

Integrating data deduplication APIs, automated scheduling, and REST API data automation provides a holistic solution to data management challenges. Here are the major benefits:

Data Accuracy: Deduplication ensures you're always working with clean, accurate data.

Time Efficiency: Scheduling removes the need for manual oversight.

Scalability: REST APIs make it easy to connect and automate workflows across multiple platforms.

Cost Savings: Reducing storage overhead and labor hours translates to significant savings.

Better Decision-Making: With real-time access to reliable data, businesses can act faster and smarter.

Real-World Use Cases

1. SaaS Platforms: Automate user data syncing across CRMs, support tools, and email platforms using REST API workflows and deduplication tools.

2. Healthcare Providers: Schedule regular updates for patient data while ensuring duplicate medical records are eliminated.

3. Financial Services: Automatically generate and distribute daily reports with accurate, de-duplicated data, improving regulatory compliance.

4. Marketing Agencies: Keep contact lists clean and synced across multiple channels using API-driven deduplication and automation.

Why Match Data Pro LLC?

At Match Data Pro LLC, we specialize in helping businesses unlock the full potential of their data with smart automation solutions. Our APIs are designed for developers, data engineers, and business teams who need reliable, secure, and scalable data tools.

Whether you’re implementing your first data deduplication API, looking to improve automated data scheduling, or developing a fully integrated REST API data automation framework, our team offers tailored solutions and expert support.

Final Thoughts

Data chaos is one of the biggest threats to business growth—but it doesn’t have to be. With the right tools and strategies, organizations can automate the tedious, clean the messy, and connect the disjointed.

By combining data deduplication, automated scheduling, and REST API automation, businesses create a lean, agile data infrastructure ready for whatever comes next. Match Data Pro LLC stands ready to help you make that transformation today.

0 notes